Officials of the Ghana Revenue Authority have been urged to design and implement a modified taxation system for the large informal sector of Ghana’s economy in order to make it easier for them to fulfil their tax obligations to the State.

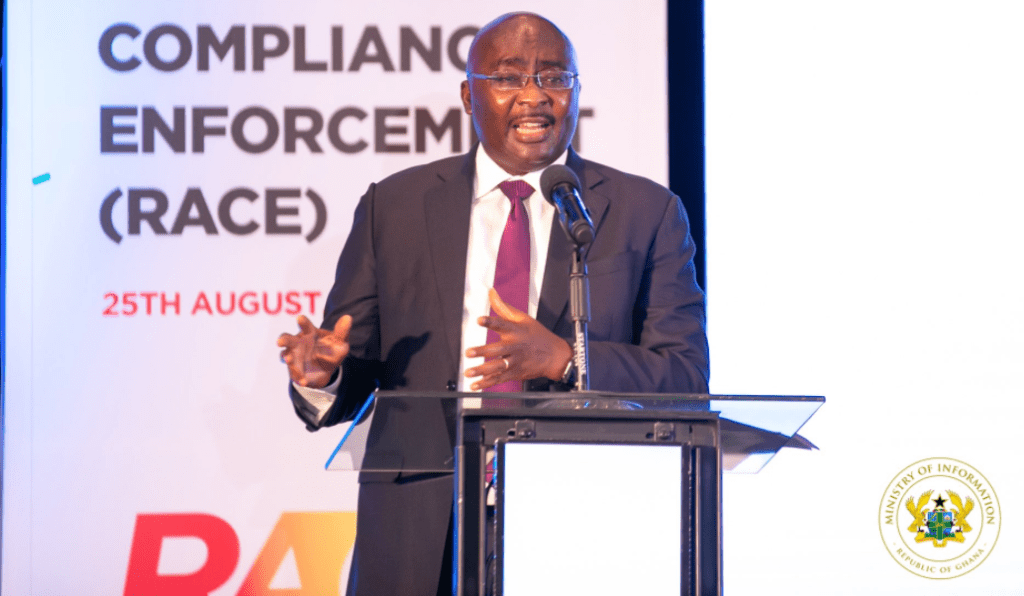

Vice President Mahamudu Bawumia, who made the call on Wednesday, 25 August 2021 said even as Government strives to create a conducive environment to simplify the tax assessment and reduce the cost of compliance to large tax payers, there is also the need to simplify enforcement and compliance at the retail and micro level.

“This group includes most of our market women, and the artisans in the informal sector. This group of potential tax payers are outside the scope of RACE.

“For these group of citizens, the issue is not with their tax evasion or tax avoidance. And their non-compliance may have more to do with their tax education and how assessment and collection are enforced. Let us find simpler ways to encourage tax compliance at this basic level.”

Vice President Bawumia was speaking at the launch of the Revenue Assurance and Compliance Enforcement (RACE) Initiative, designed to increase domestic revenue mobilization in order to address the economic challenges arising from the Covid 19 pandemic and make Ghana more fiscally independent.

Citing a recent study by the World Bank (November 2020) which indicated that potential tax revenues from sole proprietors, who usually operate in the informal sector, could amount to 12.6 percent of GDP, Dr Bawumia called on the Ministry of Finance and the Ghana Revenue Authority to consider the peculiar characteristics of the informal sector when designing the proposed modified taxation system.

“We also realise that the education as well as the nature of the businesses of operators in the informal sector results in poor record keeping. Asking such businesses to provide records for the last three or four years for an audit is an exercise in futility and will be perceived as harassment.

“We therefore need to simplify their income or profit tax assessment. One option is the use of a flat tax regime under a modified taxation system to cover micro and small enterprises which should cover most women retailers and many in the informal sector.

“For medium-sized enterprises there could be the option to submit to conventional tax assessment at the corporate tax rate or opt for a flat tax based on turnover under a modified taxation system.

“For the micro and small enterprises, we must leverage on technology to simplify the collection and payment of the 3 percent flat tax. We believe that a simplified flat tax will allow more people at the retail level to better assess their tax obligations and make payments without too much human interface and a rigorous auditing system,” he indicated.

Source: myghanadaily