Government is set to pay the outstanding salaries as well as negotiated and exit packages of former employees of the defunct 347 microfinance companies and 23 savings and loans companies.

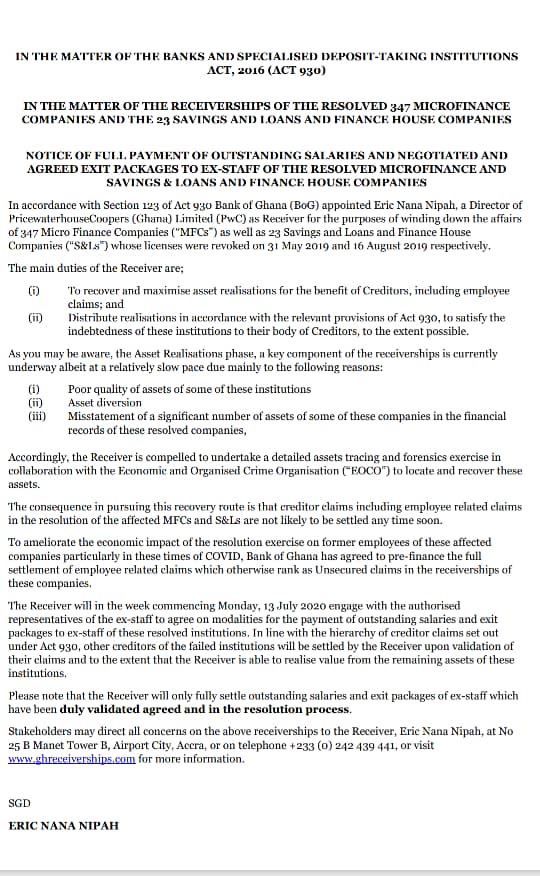

This was disclosed in a statement by the Receiver, Eric Nana Nipah, who doubles as a Director of PricewaterhouseCoopers (Ghana) Limited (PwC).

According to the Receiver, this is to alleviate the economic impact of the resolution exercise on former employees of the affected companies particularly as the economic impact of the COVID-19 pandemic is having a toll on individuals and businesses.

The Receiver also stated that consultations with authorized representatives of the former employees to agree on processes of payment will begin effective today, Monday 13th July, 2020.

“To ameliorate the economic impact of the resolution exercise on former employees of these affected companies particularly in these times of COVID, Bank of Ghana has agreed to pre-finance the full settlement of employee related claims which otherwise rank as unsecured claims in the receiverships of these companies.”

“The Receiver will in the week commencing Monday, 13 July 2020 engage with the authorized representatives of the ex-staff to agree on modalities for the payment of outstanding salaries and exit packages to ex-staff of these resolved institutions,” the Receiver added in the statement.

He further noted that he will only fully settle outstanding salaries and exit packages of former employees which have been duly validated, agreed and in the resolution process.

“In line with the hierarchy of creditor claims set out under Act 930, other creditors of the failed institutions will be settled by the Receiver upon validation of their claims and to the extent that the Receiver is able to realise value from the remaining assets of these institutions,” Eric Nana Nipah said in the statement.

It will be recalled that following the revocation of the licences of the 347 microfinance companies, the Securities and Exchange Commission (SEC) on November 18, 2019, began the validation process for the affected customers of the solvent companies to recover funds.

Accordingly, the Receiver is compelled to undertake a detailed assets tracing and forensics exercise in collaboration with the Economic and Organised Crime Organisation (“EOCO”) to locate and recover these assets.

But the receiver in the statement explains that though they are at the asset realisation stage of the receiverships, “poor quality of assets of some of these institutions, asset diversion and misstatement of a significant number of assets of some of these companies in the financial records of these resolved companies are slowing the pace of recovery.”

“The consequence in pursuing this recovery route is that creditor claims including employee related claims in the resolution of the affected MFCs and S&Ls are not likely to be settled any time soon,” he added.

On a number of occasions, the Receiver has also appealed to individuals, groups and institutions who took loan facilities from the microfinance firms to repay the loans immediately to aid in the recovery process.

Find below the full statement:

Background

The Bank of Ghana, between 2017 and 2019, revoked the licenses of nine local commercial banks and over four hundred financial institutions comprising Micro-finance, Savings and Loans as well Finance Houses, for violating various regulations guiding their operations.

This affected about 4.6 million depositors whose monies could have been lost completely had the regulators not taken the action.

It all began in August 2017, when the Bank of Ghana (BoG) gave GCB Bank Ltd the green light to acquire two local banks UT and Capital bank due to severe impairment of their capital.

Later in August 2018, the Bank of Ghana consolidated five other local banks into the Consolidated Bank Ghana Limited.

Then in May, 2019, 347 microfinance companies also had their licenses revoked by the Bank of Ghana.

The Bank of Ghana later in August 2019 again revoked the licences of twenty-three (23) insolvent savings and loans companies and finance houses.

Source: citinewsroom.com