The webinar forms part of the insurance group’s ongoing initiative to drive insurance penetration and financial inclusion in Ghana. The series, launched last year, saw the likes of reputable and seasoned business leaders like Kojo Addai-Mensah, CEO of Data Bank, Michael Kofi Andoh, NIC Deputy Commissioner, Freda Duplan, Chairperson Zenith Bank Ghana Ltd, Board of Directors, Patience Akyianu, Group CEO of Hollard Ghana, Daniel Boi Addo, MD of Hollard Insurance, Nashiru Iddrisu, and MD of Hollard Life Assurance, among others.

Speaking on the company’s motivation for the initiative, Group Head of Marketing and Corporate Affairs, Cynthia Ofori-Dwumfuo said: “As an unconventional company, with a business purpose to create and to secure a better future, we constantly seek relatable ways to positively impact the lives of Ghanaians.

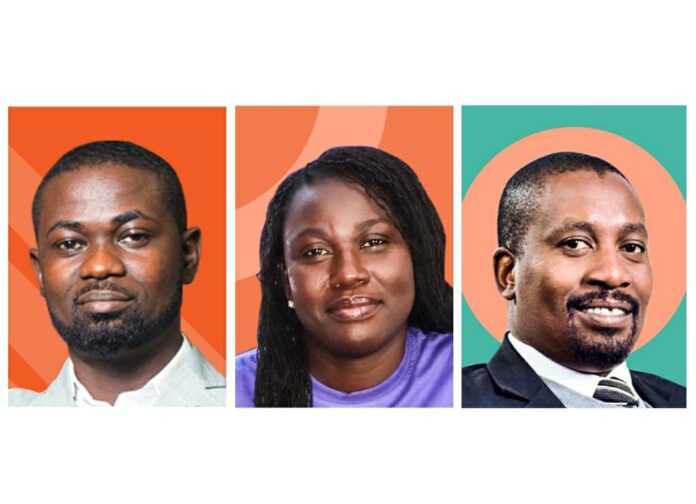

“Last season was astounding. We featured a variety of resource persons from different backgrounds to flavour our conversations on life and financial planning. With overwhelmingly positive reviews from last year, we have refreshed the series with exciting topics this season. Episode 1 of Season 2 is this Thursday, May 20th. “Does One (1) Cedi insurance make a difference” will be our focus of discussion. Collaborators of Hollard Life’s exciting new microinsurance product, MeBanbo, will discuss how customer-first thinking, innovation, and technology can positively impact Ghana’s abysmal insurance penetration rate. Join Dorothy Salifu, Head of Operations, Hollard Life, Godwin Mashiri, Chief Life & Principal Officer of top Zimbabwean company, Cassava Fintech and Martison Obeng-Adjei, Managing Director of Vodafone Cash as they sit down for an enlightening conversation,” she added.

The webinar remains free and will be streamed on Facebook live at Hollard Ghana. Just as we did last year, it will take a jargon-free and conversational format where attendees will have the opportunity to ask questions and get instant responses.

About Hollard Ghana

The country’s favourite insurance group Hollard Ghana, with subsidiaries Hollard Insurance and Hollard Life Assurance combines its deep local knowledge of the market with the world-class expertise of an international insurance brand. With feet firmly planted on Ghanaian soil but headquartered in South Africa, Hollard delivers innovative insurance solutions customized to the unique risks Ghanaians face. Hollard was previously Metropolitan Insurance which operated in Ghana for over 25 years. Hollard offers various life and general insurance products including funeral, personal accident, motor, business, home, and more; and can be reached via the following means: 0501603967 (Hollard Insurance) and 0501533698 (Hollard Life).

Beyond various nationwide office branches and Hollard 2U franchise shops, Ghanaians can find Hollard at Shell Fuel Station Welcome Shops, Melcom stores and online at www.hollard.com.ghfor all their insurance needs.

Source: Starrfmonline.com