|

Getting your Trinity Audio player ready...

|

The Ghana Revenue Authority (GRA) has disclosed that nine institutions owe the state a total of GH¢47 million in unpaid taxes as of 2023, with the Graphic Communications Group Limited, among the institutions.

According to the Auditor General’s Report of 2024, Graphic Communications Group Limited owes the GRA a debt of GH¢3.4 million, while GIHOC Distilleries owes GH¢2.1 million, with the Tema Oil Refinery (TOR) having a debt of GH¢136,000.

According to Mr Anthony Kwasi Sarpong, the GRA Commissioner General, the Authority was taking steps to recover the outstanding amounts, particularly from state-owned enterprises that attributed their inability to pay to persistent cash flow challenges.

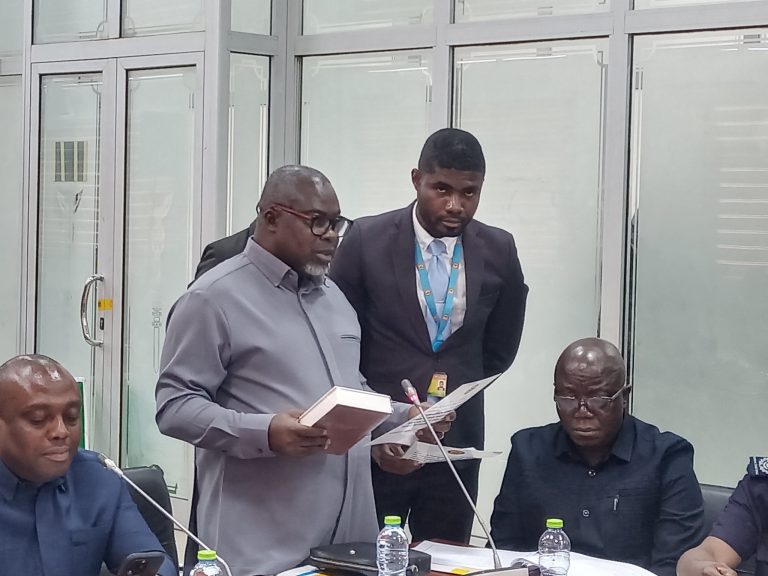

“We are intensifying efforts to recover these arrears and ensure that all institutions meet their obligations to the state,” Mr Sarpong told the Public Accounts Committee (PAC) of Parliament during its public hearing in Parliament House on Monday.

The Deputy Minister of Finance, Mr Thomas Ampem Nyarko, led the Ministry of Finance, the Controller and Accountant-General’s Department, the GRA, and other agencies under the ministry to answer some questions on infractions highlighted in the 2024 Auditor-General’s report.

Mr Sarpong emphasized that the authority was committed to improving tax compliance across all sectors.

“Madam Chair, at the GRA, it is our aim to address revenue mobilization challenges and strengthen fiscal discipline in the country,” he said.

Mr Edward Apenteng Gyamerah, Commissioner for Domestic Tax Revenue, GRA, also revealed that unpaid Value Added Tax (VAT) liabilities amounted to GH¢116 million.

The PAC public hearing, which began on Monday, August 19, ended on Monday, August 25.

The Committee is expected to reconvene on Monday, September 29, to examine the Auditor-General’s report on MDAs for the year ended December 31, 2024, Madam Abena Osei Asare, the Chairperson of PAC, announced after Monday’s hearing.

Source: myghanadaily