|

Getting your Trinity Audio player ready...

|

The Gulf Cooperation Council (GCC), comprising Saudi Arabia, the United Arab Emirates

(UAE), Qatar, Kuwait, Bahrain, and Oman, has significantly increased its engagement with

Africa in recent years. This expansion is driven by economic diversification, strategic

investments, and a growing interest in Africa’s natural resources, infrastructure, and markets.

As GCC nations seek to reduce their dependence on oil, Africa presents new opportunities for

trade, investment, and geopolitical influence.

GCC-Africa Trade Relations

Trade between GCC countries and Africa has grown substantially, with a focus on energy,

food security, and manufacturing. Key aspects of this relationship include:

Energy Trade: The GCC-Africa energy relationship is driven by both oil exports and

renewable energy collaborations. Africa is a key crude oil supplier to the GCC, with Nigeria

exporting over 100,000 barrels per day to the UAE and Saudi Arabia. On the other hand, the

GCC provides refined petroleum products and gas to African nations. In 2022, the UAE’s

ADNOC supplied over $1.2 billion worth of refined petroleum to Africa, ensuring energy

security in countries like Egypt, Kenya, and South Africa. Additionally, Saudi Aramco has

initiated discussions for joint refinery projects in Africa to reduce energy import dependency.

Food Security: Africa’s vast agricultural lands are a key focus for GCC countries, which

import large quantities of food to meet domestic demand. The UAE, through Agthia Group

and Al Dahra, has invested over $500 million in Sudan, Ethiopia, and Egypt to secure grain

and livestock production. Saudi Arabia’s SALIC (Saudi Agricultural and Livestock

Investment Company) has acquired farmlands in Sudan and invested over $1.3 billion in food

production projects across Africa to ensure stable food supply chains. In 2023, Africa

accounted for nearly 30% of Saudi Arabia’s imported grains and livestock.

Manufacturing & Logistics: Ports in Djibouti, Kenya, and Tanzania are becoming critical

for Gulf investors looking to expand supply chain networks. The UAE’s DP World has

invested over $2 billion in African ports, including the expansion of the Berbera Port in

Somaliland and the development of logistics hubs in Senegal and Egypt. In 2022, DP World

handled over 12 million TEUs (twenty-foot equivalent units) of cargo across Africa,

enhancing trade connectivity. Saudi Arabia’s Public Investment Fund (PIF) has also

announced plans to invest $1 billion in African logistics and transport infrastructure to

support manufacturing growth.

Strategic Investments by GCC Nations

Infrastructure &Transport: GCC investments in Africa’s transport and infrastructure sectors are growing rapidly. The UAE’s DP World, a major player in African port operations, has invested over $1 billion in upgrading ports in Senegal, Egypt, and Somaliland. The UAE and Saudi Arabia have also pledged funding for road and rail projects, including the $3 billion Lapsset Corridor Project in Kenya, enhancing regional connectivity. The expansion of Tanger Med Port in Morocco, backed by Gulf investors, has positioned it as Africa’s largest shipping hub, handling over 7 million containers annually.

Energy & Renewable Projects: The GCC is driving Africa’s renewable energy transition,

with Masdar (UAE) leading solar and wind projects across the continent. In 2023, Masdar

announced a $10 billion investment plan in Egypt, aiming to develop 10 GW of renewable

energy capacity. Saudi Arabia’s ACWA Power is constructing a $500 million solar power

plant in South Africa, contributing to the country's shift from coal-based energy. Qatar has

also entered the renewable energy space, with its Qatar Investment Authority (QIA) investing

$2 billion in African solar and wind farms, particularly in Sudan and Ethiopia.

Mining & Natural Resources: Africa’s rich mineral resources have attracted significant

GCC investments, particularly in gold, copper, and lithium. Saudi Arabia’s Ma’aden, one of

the world’s largest mining companies, has partnered with African nations to explore gold

mining in Sudan and Mauritania. UAE-based companies have invested over $5 billion in

Africa’s lithium mining sector, particularly in the Democratic Republic of Congo and

Zimbabwe, securing key raw materials for electric vehicle production. Qatar is also investing

in Africa’s gas sector, committing $3 billion to Mozambique’s LNG projects, reinforcing its

role as a global energy powerhouse.

Real Estate &Tourism: The GCC’s investment in Africa’s real estate and tourism sectors is

surging. Dubai-based Emaar Properties has launched luxury hotel and residential projects in

Egypt, Morocco, and Kenya, worth over $4 billion. Saudi Arabia’s Public Investment Fund

(PIF) is backing tourism projects in South Africa and the Seychelles, aligning with its Vision

2030 tourism expansion strategy. Qatar’s Katara Hospitality has acquired stakes in several

five-star hotels in Cairo and Zanzibar, aiming to boost the region’s appeal as a high-end

tourism destination. These investments are enhancing Africa’s real estate landscape and

driving economic growth.

Geopolitical Influence & Strategic Partnerships

GCC nations are leveraging their economic power to strengthen political ties with African

nations. Key aspects include:

Military and Security Cooperation: The UAE and Saudi Arabia have established military

bases in Djibouti and Eritrea, securing strategic locations along the Red Sea. In 2023, Saudi

Arabia announced a $1 billion defence cooperation deal with African nations to enhance

regional security. The UAE has also provided military aid to counterterrorism operations in

Somalia and the Sahel, strengthening its regional influence and securing maritime trade

routes.

Soft Power Diplomacy: GCC countries are expanding their influence through cultural and

educational programs. Saudi Arabia funds scholarships for thousands of African students in

Riyadh and Jeddah, while Qatar’s Education Above All foundation has helped educate over

10 million children in Africa. The UAE’s humanitarian efforts include a $500 million aid

package for African countries affected by drought and food shortages in 2023.

Multilateral Collaborations: The Gulf states are deepening relations with African organizations like the African Union (AU) and ECOWAS. In 2023, the UAE pledged $4.5 billion for Africa’s clean energy projects at the COP28 summit. Saudi Arabia also signed new agreements with South Africa and Kenya to enhance trade and investment, reinforcing its economic and diplomatic ties with key African markets.

Challenges & Future Prospects

Despite growing engagement, challenges remain, including political instability in some African nations, regulatory hurdles, and competition from China and Western investors. However, as GCC countries continue diversifying their economies, Africa will remain a key region for trade and investment. GCC member, Saudi Arabia has big plans for investing in Africa, with a commitment to provide at least $41 billion in funding for low-income sub-Saharan countries over the next decade. This investment will be spread across various sectors:

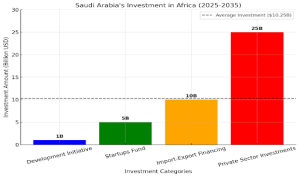

Saudi Arabia’s investment in Africa over the next decade. The private sector investment is the

largest at $25 billion, followed by trade financing at $10 billion financing from the Saudi

Import-Export Bank, providing access to capital for African businesses, Startups support at

$5 billion, and the development initiative at $1 billion focusing on sustainable development

and economic growth.

Trend Analysis: The average investment across all categories is $10.25 billion, indicated by

the dashed line. Private sector investments dominate (61% of total funding), showing Saudi

Arabia’s strong interest in infrastructure, energy, and agriculture. Startups and trade financing

receive significant support, emphasizing economic growth through entrepreneurship and

business expansion. Sustainable development gets the least allocation ($1B), suggesting more

room for policy engagement to enhance social programs.

Saudi Arabia’s state-owned oil company, Aramco, is also exploring investment opportunities

in Africa, particularly in the energy sector. Additionally, ACWA Power, a Saudi-based

company, has already invested over $7 billion in Africa and plans to further expand its

footprint on the continent. These investments are part of Saudi Arabia's broader strategy to

strengthen its economic ties with Africa and promote sustainable development on the

continent.

Conclusion

The GCC’s expanding footprint in Africa is shaping the continent’s economic landscape.

With increasing investments in trade, infrastructure, and energy, Gulf nations are poised to

become long-term partners in Africa’s growth. Moving forward, strengthened diplomatic and

economic relations will further cement the GCC’s role as a key player in Africa’s

development.