Managing personal finances today is more complicated and more important than ever. Scores of us feel less secure in our jobs and homes than we did in the past. We see our money being drained by the high cost of housing, taxes, education, and healthcare while dealing with the uncertainty of investments and our economy. We worry about the future, or unfortunately in many cases, simply try not to think about it.

According to the World Bank, the average life expectancy in Ghana stood at 64 years in 2020. With so many people on the verge of running out of money before their life expectancy, many families burdened with large amounts of student loans and other forms of debt, and more than half of our adults not having up-to-date estate and financial plans to protect themselves and their families, it poses a serious problem for us.

This lack of financial awareness and financial literacy places HUGE pressure on families and friends, employers, nonprofits, as well as the government. During the three-week COVID-19 partial lockdown in Ghana, for instance, the government of Ghana, aside from free water and 50% electricity subsidy for residential users, provided hot meals to some vulnerable. It is estimated that the government spent GH¢54.3 million ($9,383,487) on cooked food to some 470,000 families. That aside, the Ghana COVID-19 Private Sector Fund rolled out the FEED-A-KAYAYO Project that provided a total of 145,746 packs of food from April 1, 2020, to 12 April 2020. This was estimated at a cost of GHS906,541.

This government and private sector-led support to individuals and families in the wake of the COVID-19 lockdown is proof that the habit of saving for emergencies and building up financial investment for the future has been relegated to the background by many in our society.

TODAY’S THOUGHT

“Great things are not done by impulse, but by a series of small things brought together”

~ Vincent Van Gogh

Despite all these is a real solution to this lack of financial awareness and financial literacy epidemic. This includes proper education of the general public on the essential principles to smart personal financial management while motivating them to make appropriate decisions. People need access to better personal financial management tools and information, to communicate and work more effectively with their financial advisors, and to make better everyday informed money decisions.

Financial management means much more than budgeting and putting money away for retirement. It is being equipped to handle a lifetime of financial challenges, needs, and changes. It involves figuring out how to build assets and staying ahead of inflation, taking advantage of deflation, and choosing wisely from a constantly widening field of savings, investment, and insurance options. When it comes to finances, people are faced with more pressures and more possibilities than ever before in the midst of our increasingly competitive and complex financial market.

The good news is that as complex as today’s financial world is, there is no real mystery to sound personal money management. You do not need a master’s degree in finance or accounting to get ahead.

What you do need are the solid basic principles of organization, personal finance, and decision-making, plus the willingness to put them into action. Anyone with a fundamental education and the desire to handle money wisely can do it.

Effective financial management does involve certain procedures that you do not automatically learn from your parents or associates – and they certainly are not taught in our schools. The current curricula in our basic schools make no effort or little effort at providing this knowledge. It is more than just a matter of gathering enough information and then making a logical decision. In fact, for many people, the constant bombardment of economic news, fragmented financial information, and investment product advertisements in the media is part of the problem. Information overload can be a major obstacle to sorting out choices and making wise decisions.

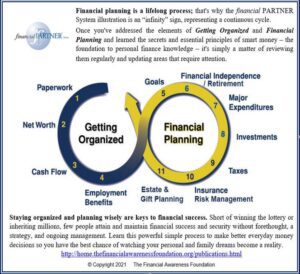

To save time and money, and help you to better manage your finances, we developed a personal financial management system called Your financial PARTNER. It is a clear, step-by-step process designed to save you time and money and puts all the essential areas of personal finance in front of you with its core principles.

The process centers on helping you to get organized, on staying aware of your money issues, and on making deliberate choices about the ways you spend, save and invest instead of following your emotions or simply “going with the flow.” Figure 1, represents the Your financial PARTNER System, an 11-part process that is divided into two phases: Getting Organized and Financial Planning.

There is a real solution to the lack of financial awareness and financial literacy epidemic

To know more about the movement, click on the links below;

The Improving Financial Awareness & Financial Literacy Movement in Ghana Executive Summary Overview:

http://www.thefinancialawarenessfoundation.org/pdf/TFAF-TIFA-FLMovement-Ghana-ExecSum.pdf

The International Improving Financial Awareness & Financial Literacy Association (The FA Association) at the University of Ghana Website: http://ugbs.ug.edu.gh/association

Join The Improving Financial Awareness & Financial Literacy Movement in Ghana

http://www.thefinancialawarenessfoundation.org/pdf/TFAF-Ghana-JoinTheMovement-PersonalFinKnowledge.pdf

We believe that sharing the essential principles to personal financial knowledge changes your world and the world around you, FOREVER.

To be continued…

This article is an excerpt from the Improving Financial Awareness & Financial Literacy Feature Column Series 001 Issue | Vol 1| 2021 and was edited by Myghanadaily.com