|

Getting your Trinity Audio player ready...

|

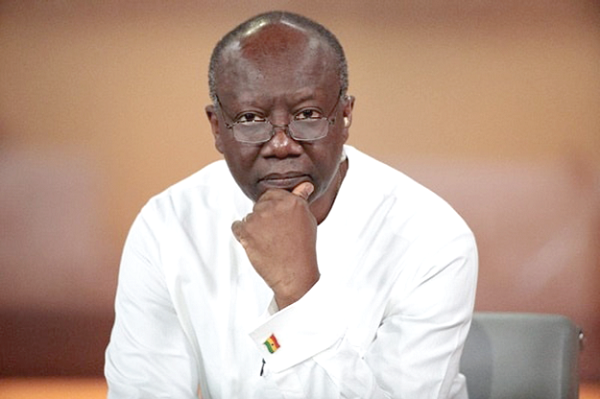

The Finance Minister has proposed in the 2023 budget presentation an increment in the Value Added Tax (VAT) by 2.5 per cent.

The standard VAT rate is 12.5%, except for supplies of a wholesaler or retailer of goods, which are taxed at a total flat rate of 3%.

The proposal to increase the rate forms part of the seven point agenda to revitalize the economy, the Finance Minister told Parliament on Thursday November 24.

The seven-point agenda is ‘Aggressively mobilize domestic revenue; Streamline and rationalise expenditures; Boost local productive capacity; Promote and diversify exports; Protect the poor and vulnerable; Expand digital and climate-responsive physical infrastructure; and Implement structural and public sector reforms.’

He also announced that the government will undertake major structural reforms in the public sector.

Regarding the economic challenges, he told Parliament that the government was determined to change the narrative after admitting that the country has been going through troubles.

“The government is determined to change the negative narrative and rebuild for a better future,” he said.

Source: myghanadaily