After financing phase one in 2019, Deutsche Bank announce today the closing of a new lending facility to finance phase two of the Kumasi Market redevelopment project in the Republic of Ghana, together with the UK Export Finance Agency (UKEF) and African Export-Import Bank (Afreximbank).

The 184 million euro financing consists of a 145 million euro loan supported by UKEF and a 39 million euro commercial loan by Afreximbank. Deutsche Bank acted as the sole structuring bank and mandated lead arranger for the two loans.

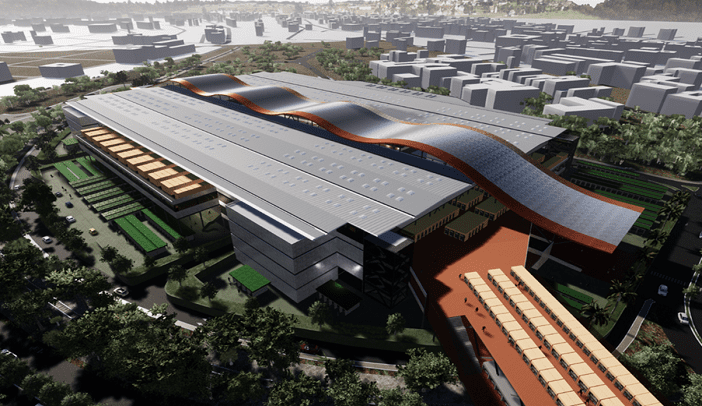

The Kumasi Market is the largest market in West Africa. It not only serves the Kumasi region, but also acts as a magnet for traders from neighbouring countries such as Benin and Togo. Before its redevelopment, it comprised of more than 12,000 stores and stalls, with footfall of around half a million people each day. However, regular fire outbreaks resulted in the destruction of stalls and loss of livelihoods prompting its redevelopment. The overall construction was awarded to Contracta Construction UK Limited and has been split into three phases to minimise disruption in the Kumasi business district and ensure the market continues operating at all times.

Commenting on the transaction, Alarik d’Ornhjelm, Head of Structured Trade & Export Finance for Middle East and Africa at Deutsche Bank, said: “We are pleased to be again involved in the redevelopment of this iconic marketplace. This further development of the market will boost economic activities and provide social benefits to the local community.”

Harriet Thompson, British High Commissioner to Ghana, said: “When I visited Kejetia Market last year, I met the stall owners and market traders, many of whom are women, working in the newly completed phase one of the market, I heard first-hand the positive impact the development has had on their businesses, their families and the community within the market, which spans generations. This positive impact is thanks to the partnership between the UKEF, Ghana and Deutsche Bank which has and continues to support the growth of Kumasi’s trading centre through the development of the region’s largest market. I look forward to visiting the market again to see the second phase progress.”

As the transaction plays a key role in assisting the socioeconomic advancement of a number of local small and medium enterprises in the overall supply chain, it will contribute towards Deutsche Bank’s target of facilitating over 200 billion euros in sustainable finance and investments by 2023.

Since 2011, Deutsche Bank has arranged over 3 billion euro of financing across over 20 transactions to support critical infrastructure development in Ghana most of which are social loans supported by Export Credit Agencies (ECAs). In July 2021, the bank announced the closure of two social loans with the Republic of Ghana to fund four health and two transportation projects. The bank also announced signing an approximate 600 million euro agreement to finance the construction of a 100km stretch of Ghana’s Western Railway Line, running from Takoradi Port to Huni Valley.

For further information, please contact:

Deutsche Bank AG Media Relations

Mohanad Nahas

Phone: +971(4) 3611-754

E-Mail: mohanad.nahas@db.com

About Deutsche Bank in Africa

Since opening a representative office in Cairo in 1959, Deutsche Bank has strongly contributed to financing the development of infrastructure across the African continent. The bank uses its expertise in structuring and arranging financing to help countries access the traditional global capital markets and other alternative pools of liquidity.

Deutsche Bank has well over 200 staff providing banking services to our clients on the African continent. We have teams situated in our branch in Johannesburg, South Africa and representative offices in Lagos, Nigeria and Cairo, Egypt. In addition, there are a number of coverage bankers and product specialists based in our regional hub for the Middle East & Africa, Dubai and other global hubs including Frankfurt, London and Geneva (amongst others), that provide banking services to clients and individuals domiciled on the continent.

Last year, for the second year in a row, Deutsche Bank has been named Best Foreign Investment Bank in Africa at the EMEA Finance Magazine’s African Banking Awards in its 2020 cycle. Furthermore, in recognition of its integral role in supporting the African economy, the jury also named Deutsche Bank the Best Foreign Investment Bank in Angola, Cote d’Ivoire, Gabon and Niger.

Disclaimers and disclosures

Deutsche Bank AG, Dubai (DIFC) Branch is a branch of Deutsche Bank AG located and registered in the Dubai International Financial Centre (DIFC) in the Emirate of Dubai, United Arab Emirates, with registered no. 00062. Principal place of business in the DIFC: Dubai International Financial Centre, Gate Village, Building 5, PO Box 504902, Dubai, United Arab Emirates. Deutsche Bank AG, Dubai (DIFC) Branch is regulated by the Dubai Financial Services Authority (“DFSA”) and is authorized to provide Financial Services to Professional Clients only, as defined by the DFSA.

This release contains forward-looking statements. Forward-looking statements are statements that are not historical facts; they include statements about our beliefs and expectations and the assumptions underlying them. These statements are based on plans, estimates and projections as they are currently available to the management of Deutsche Bank. Forward-looking statements therefore speak only as of the date they are made, and we undertake no obligation to update publicly any of them in light of new information or future events.

By their very nature, forward-looking statements involve risks and uncertainties. A number of important factors could therefore cause actual results to differ materially from those contained in any forward-looking statement. Such factors include the conditions in the financial markets in Germany, in Europe, in the United States and elsewhere from which we derive a substantial portion of our revenues and in which we hold a substantial portion of our assets, the development of asset prices and market volatility, potential defaults of borrowers or trading counterparties, the implementation of our strategic initiatives, the reliability of our risk management policies, procedures and methods, and other risks referenced in our filings with the U.S. Securities and Exchange Commission. Such factors are described in detail in our SEC Form 20-F of 20 March 2020 under the heading “Risk Factors”. Copies of this document are readily available upon request or can be downloaded from www.db.com/ir.

Source: country.db.com